Case studies

CASE STUDY

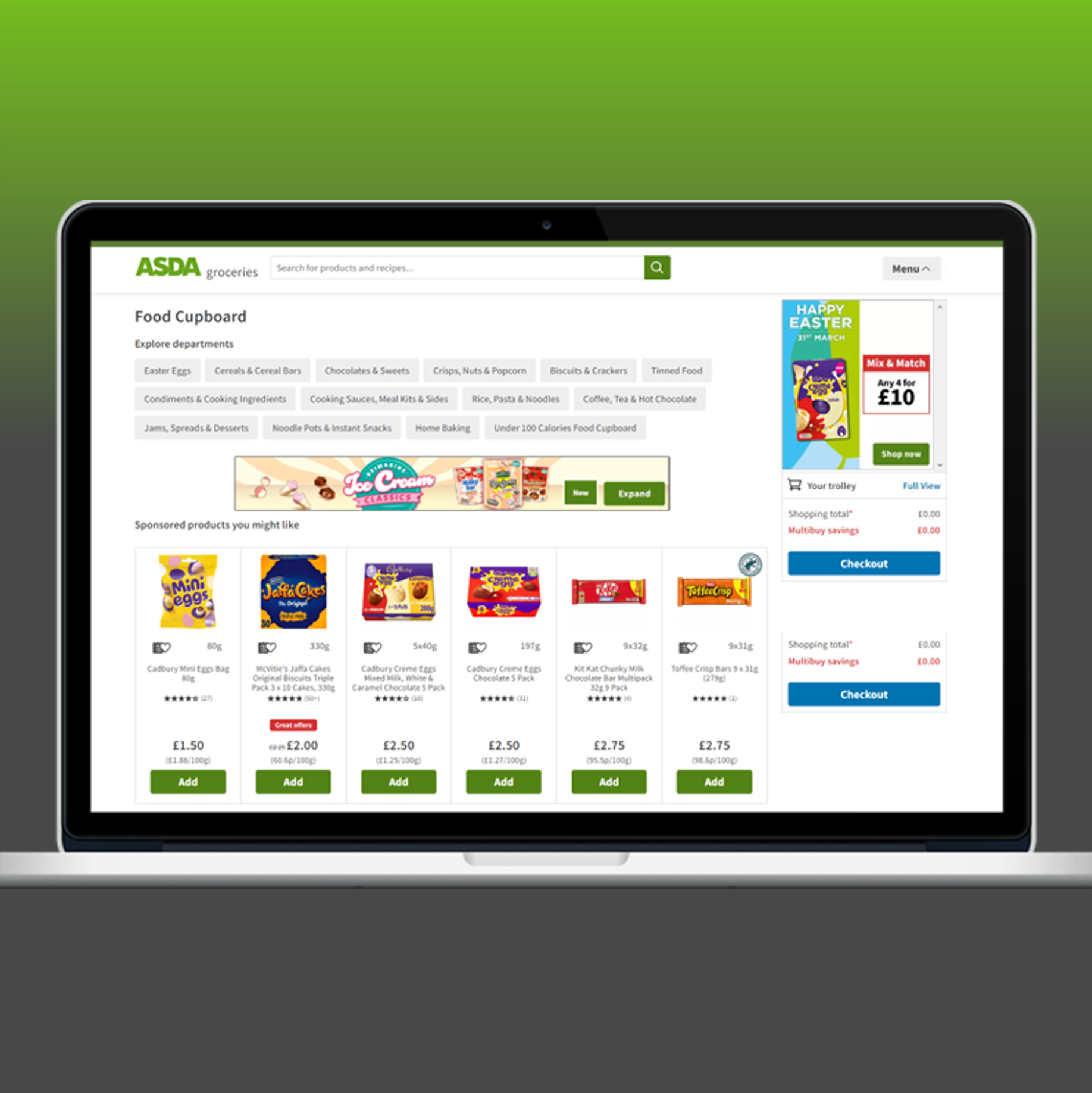

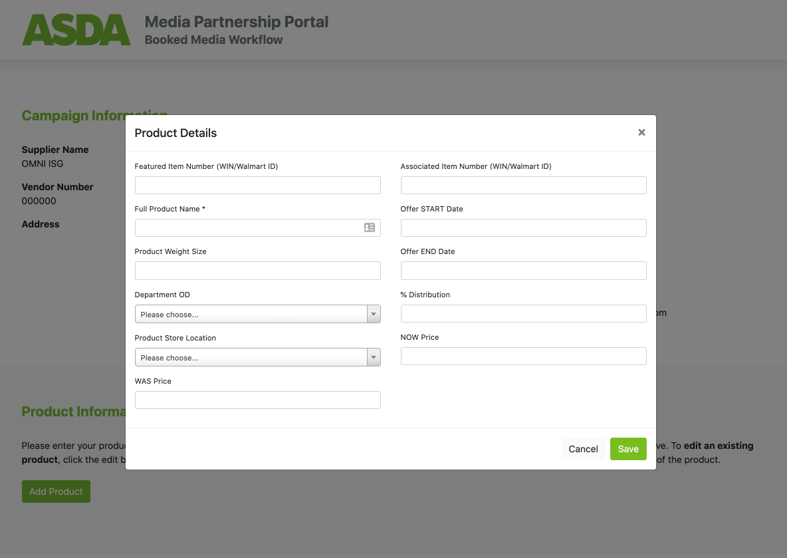

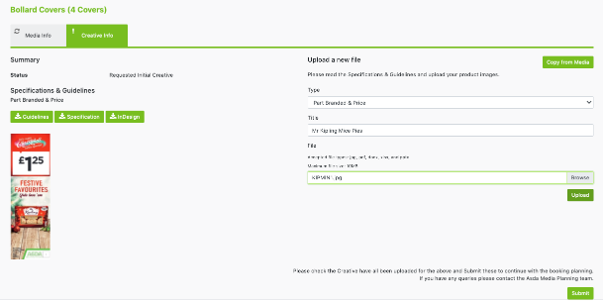

Workflow automation

CHALLENGE

Create and optimise business processes for digital and physical media campaign sales.

Design an end-to-end omnichannel process that can manage over 4,000 campaigns each year.

BARRIERS

This is a highly complex process that involves multiple internal departments as well as external stakeholders, managing the needs of sales, marketing, and 3rd party vendors in tech, data and reporting.

SOLUTION

Developed a custom web portal that integrated with the booking platform, that both suppliers and operations teams use to ensure all media briefs and creatives are captured correctly and on time.

Automation was built into the portal, automatically alerting suppliers to each stage of the process with step-by-step instructions on how to complete briefing forms, select live dates, define KPIs, upload creative assets, and approve final campaign artwork.

The time-saving enabled by automation allowed the operations teams to focus on challenges or non-standard queries, with the net result of getting more media live accurately and on time.

RESULTS

Improved customer satisfaction from the supplier-base

Improved media operations scores enabled by time-saving

More media executed on time, in the correct location, with the correct creative

CASE STUDY

SOLUTION

An immediate synergy between Smart Energy GB’s target audience and Poundland’s ‘shop-savvy’ audience made this an obvious partnership.

Energy Smart messaging around key products and locations meant that Poundland shoppers could make energy-saving decisions on the products they buy everyday, whether that’s choosing the most efficient lightbulb or the washing powder that washes best at cooler temperatures. Shoppers could also access via QR, further Smart Energy GB content from the media in-store and online.

CHALLENGE

Increase awareness, perception and uptake of smart meters among consumers who are actively looking to make financial savings.

Smart Energy GB and Poundland, Non-Endemic Partnership

CASE STUDY

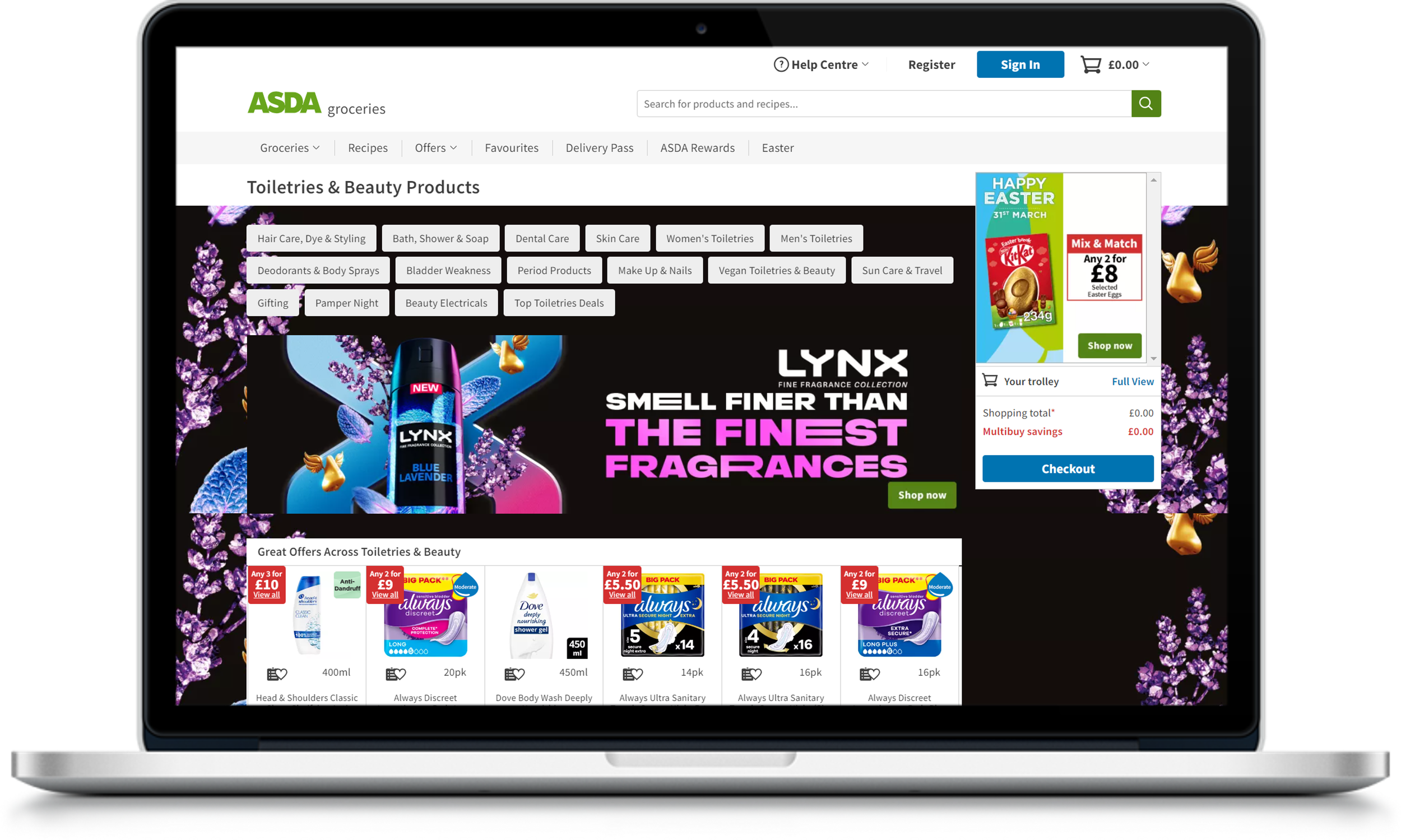

HISTORY

GIG Retail began working with ASDA Media Partnerships in 2014, managing in-store media sales. In 2018 GIG’s remit expanded to include digital media sales, as well as campaign management, post-campaign reporting and the overall management of all third-party media providers. Additionally, GIG created all media sales collateral and B2B comms, making AMP’s retail media proposition easy to understand and easy to buy.

The Growth of ASDA Media Partnerships

GROWTH

ASDA now has the most comprehensive retail media portfolio in the grocery market, spanning print, OOH, carpark media, in-store radio, point-of-sale, digital display, social media and experiential. Since 2014, retail media revenue has grown 434%.

CASE STUDY

Digital Media: Tenancy to CPM Migration

CHALLENGE

To accelerate retail media growth by transitioning digital media from a tenancy buy, to a CPM model.

SOLUTION

GIG Retail led the vendor selection process, appointing Criteo to deliver a quick integration that gave suppliers access to industry-standard IAB ad formats and more granular targeting options. A second partnership with Scoota unlocked a suite of rich media.

RESULTS

Implementation of a CPM model meant an increase in ad inventory, the introduction of Sponsored Products, real-time view of media availability, and accelerated digital revenue growth.

A selection of objective-based digital media packages, combined with automated booking and ad creative made media buying quicker and easier both for advertisers and for AMP, while enabling in-flight optimisation, improved campaign performance and a reduction in the volume of monthly invoices.

Campaign reporting capability expanded from impressions and CTR to also include ROI and media attribution, so that advertisers could account for every £ spent.

Overall, these upgrades drove increased campaign performance, improved analytics which improved data-led media planning, and greater media investment from suppliers and brands.

CASE STUDY

Launching the first discount retailer media centre in the UK

CHALLENGE

To launch, manage and grow the first discount retailer media centre in the UK, with an ambitious seven-figure target of new media revenue in the first year.

SOLUTION

Analysis of the discount sector, and of Poundland’s commercials enabled GIG to evaluate the opportunity size and investment required.

A detailed rollout plan was activated alongside an in-depth sales proposition for suppliers, a suite of sales collateral, ad templates, reporting templates, as well as the recruitment of a media sales team.

The first discounter retail media network in the UK was launched in September 2021 and has expanded to now include a greater media portfolio including branded bays, an ecommerce website, digital screens in-store and most recently the Poundland Perks app.

CASE STUDY

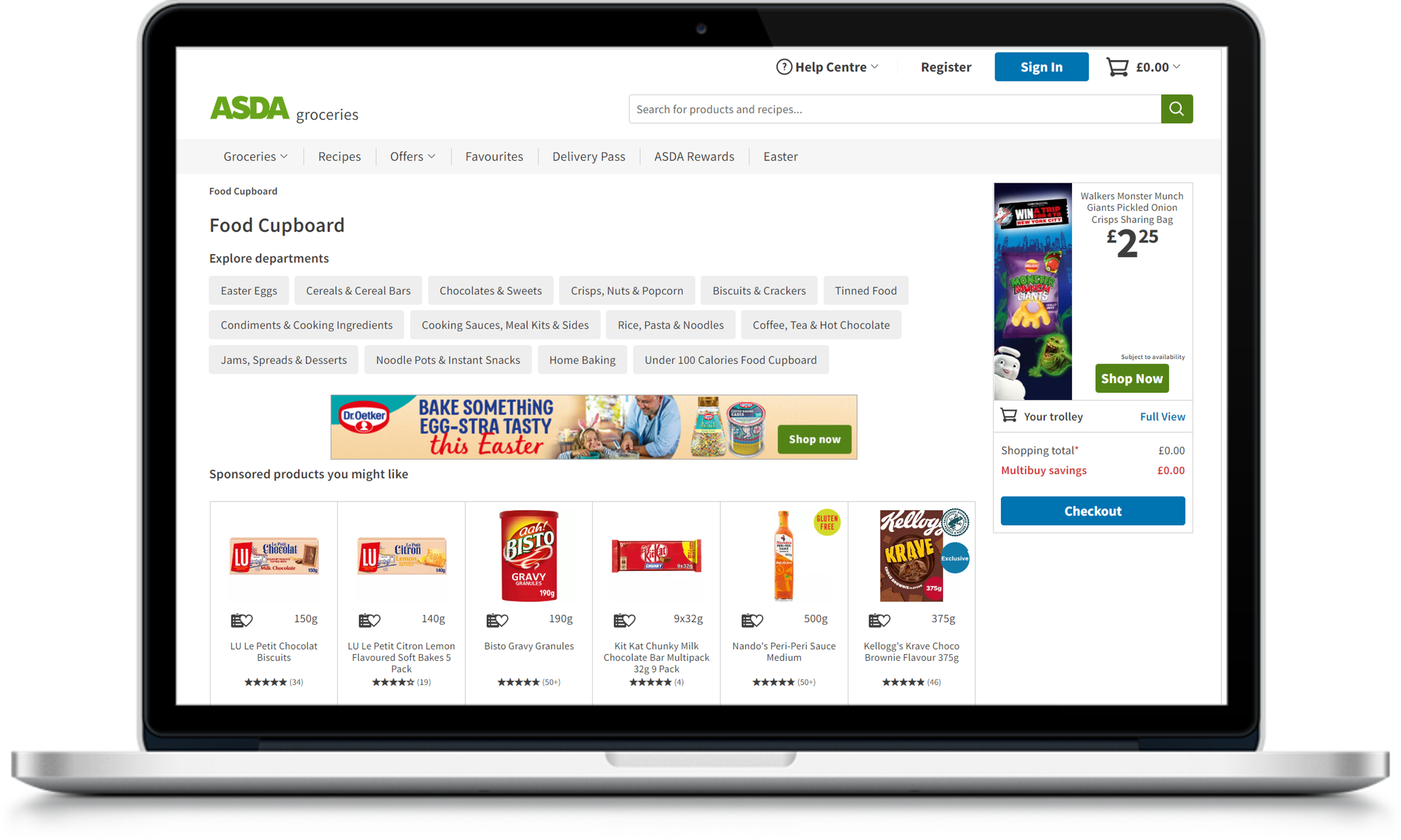

Digital media packages

CHALLENGE

Orchestrate a shift from single-line media bookings, to the optimum media combination for the supplier’s desired outcome and budget.

SOLUTION

A selection of digital media packages, anchored in data insight were built around key objectives and outcomes. In doing so, it was no longer possible to book singular media in isolation.

At the point of booking, advertisers were made aware of the metrics to be captured, data output and performance benchmarks. Advertisers knew exactly what to expect so that when it came to the post campaign report, it was simply a case of analysing performance against those prerequisites.

RESULTS

A notable upturn in campaign performance, which in-turn drove investment growth from advertisers. Campaign performance could now be monitored in-flight, with media optimized to utilse the best performing formats or creative.

Additionally, significant time savings were made for suppliers and AMP staff due to automated booking and creative, as well as in package billing vs. the previous line-item billing.

CASE STUDY

Sizing the opportunity for a South African retail group

CHALLENGE

Assess the size of the retail media opportunity across four different retail banners within the group, and advise on the strategy, structure and investment required to launch.

SOLUTION

Analysis of the competitive set, our client’s commercials and their existing media capabilities enabled GIG to forecast the size of their retail media opportunity and the media infrastructure required to achieve it. A detailed, costed list of media recommendations, activation processes and people structure was provided, followed by a proof of concept campaign to demonstrate the credibility of GIG’s recommendations.