News & Views

Iceland and The Food Warehouse partner with GIG Retail to accelerate retail media growth

Iceland and The Food Warehouse have partnered with retail media growth specialist, GIG Retail to fast-track their retail media ambition: to deliver the best possible customer experience through targeted brand inspiration and media innovation.

Offering one of the most extensive, full-funnel retail media portfolios in the market, Iceland Retail Media enables brands to reach, engage and influence the purchase decisions of a vast audience of over 9m monthly shoppers, enhancing the customer journey at every touchpoint, from sofa to store.

Adam Smith, Head of Retail Media at Iceland said: “We are excited to be partnering with Gig Retail to further our retail media capabilities. The partnership will deliver strong results for our suppliers, with new ways of working and embracing new approaches set to deliver the strongest retail media network of any UK retailer.”

Media innovation is high on the agenda, digitising the store experience with the imminent rollout of in-store screens incorporating audience tracking technology, in partnership with Stratacache, while the introduction of ad-served media online will increase ad relevancy and targeting capability. Iceland’s end to end retail media operations will be managed through a new purpose-built platform - allowing real-time inventory management, automated artwork approval, and robust media measurement and reporting, enabling brands to easily track campaign performance and ROAS.

Not restricted to supplier investors alone, Iceland’s media portfolio is available to non-endemic brands who can benefit from a huge, valuable audience of active consumers. The first of these partnerships delivered by GIG Retail, has already gone live with Smart Energy GB.

GIG’s experience in managing large scale retail media complexity means that advertising brands will benefit from simplified processes from concept to activation, a renewed focus on full-funnel omnichannel media planning that puts the customer first through relevant, inspiring content, while maximising campaign performance through in-flight optimisation.

So, what else can brands look forward to?

Whilst frozen food is at the heart of Iceland and The Food Warehouse, their extensive range of chilled, ambient and non-edible SKUs make it a growing destination for the full household shop. Partnerships with well-known brands such as TGI Fridays, My Protein, Harry Ramsdens and Greggs add further appeal, while free home delivery and their reputation for great value drive basket size growth.

While many of the other supermarkets wrestle with their identity and what they stand for, Iceland is steadfast in its position: doing the right thing by its customers – offering great products and great quality, at great value. Recent store upgrades and an attractive brand portfolio make shopping at Iceland a celebration – an experience that increasing numbers of shoppers choose to enjoy each week. Iceland is a retailer in sharp growth, seen to be doing the right thing by its customers, creating a brand-safe environment where advertising can have an immediate impact on shopper’s purchase decisions.

Iceland’s collaboration with GIG Retail means that brands can easily access consumers through an easy to understand and easy to buy media proposition. GIG Retail have a strong track record of retail media delivery, most famously during their 10-year partnership with ASDA, as well as providing retail media services for some of the world’s biggest retailers.

The benefits of retail media in upper-funnel advertising.

Erinne Boyes - Director of Operations - GIG Retail

Erinne spent many years working for Carat, one of the biggest media planning and buying agencies in the UK.

Since moving to GIG Retail in 2019, Erinne quickly recognised that retail media answered many of the challenges that brands had; and by leveraging the power of retail media, could make media planning more efficient and accountable.

The media landscape

Traditionally retail media’s place on planners’ schedules has been limited to conversion and digital formats – focusing on capturing in market consumers and driving immediate sales of a particular product.

However, in an increasingly fragmented mass media landscape where not only ROAS but attention, engagement and brand awareness are critical metrics, retail media is coming into its own and commanding a place higher up the comms funnel.

New media formats, enhanced buying models, easier access to inventory (for endemic and non-endemic brands) and improving measurement have allowed retail media to become a valuable asset for upper-funnel advertising and brand building.

First party data

One of the biggest advantages of retail media for upper funnel advertising is precise audience profiling and targeting through first-party data.

Unlike traditional media, which often relies on third-party data, retail media taps directly into data collected by retailers, including browsing habits, shopping patterns, and purchase histories. This data enables brands to reach consumers who align with their target demographics and interests, even before they are in an active purchasing mindset.

For instance, a skincare brand can target audiences frequently browsing beauty sections, increasing the chances of brand exposure to relevant, high-intent audiences. Digital screens or in-store radio can be dialled up or down dependent on sales data, combining other contextual triggers such as the weather.

Visibility and scale

Another core benefit is enhanced brand visibility. Mass audiences are becoming harder to find but retailers can offer up large reach and impressions.

Retail media places brand messages directly, and unavoidably, where consumers are already in a shopping mode, creating a top-of-mind effect.

Upper-funnel placements like screens at store entrance, foyer/aisle takeovers, and homepage banners are prime opportunities for brands to showcase their identity, values and range, and build further recall.

A recent survey by Inmar found that 69%

of shoppers recall noticing in-store product promotions, which led to further browsing and purchases - highlighting the clear influence that thoughtful and well-positioned branding within a store’s physical space, has on consumer behaviour.

Actionable insight

Retail media also offers highly measurable and actionable data, which is instrumental for optimising upper-funnel campaigns.

Traditional brand advertising can be challenging to measure, especially in terms of its direct impact on consumer behaviour. Historically, retail media provides real-time insights on engagement metrics like impressions, clicks, and time spent on ads. This data allows advertisers to measure the effectiveness of their campaigns and quickly optimise.

However, retailers and brands are now looking to employ more brand lift studies and other long term measurement tools such as advanced Market Mix Modelling and machine learning techniques to evaluate shifts in longer-term brand perception and consideration, providing tangible feedback for brand-building efforts.

Brand storytelling

Lastly, retail media supports seamless integration of brand storytelling.

Brands can craft compelling narratives through high-impact formats like videos, interactive ads, and sponsored content, mirroring ATL messaging and all integrated into the ‘brand-safe’ retail environment.

Retailers are learning to reduce the need for templated creative formats and allow brands more creative freedom to be brought to life in the store ‘theatre’ environment.

In summary

Retail media serves as a multi-functional channel that enables brands to reach, engage, and influence potential customers throughout their purchase journey. By effectively leveraging first-party data, optimising visibility, and employing measurable strategies, retail media enhances upper funnel advertising, strengthening brand awareness & consideration and fostering long-term consumer loyalty.

Retail media isn’t trying to replace traditional top-of-funnel media, but be an extended, extremely complimentary and accountable addition.

With audience reach potential comparable to many traditional channels, retail media should be a key consideration for the smart media planner!

Don’t forget the power of creative in connecting with your audience

Axel Tulip - Client Director at GIG RetailHave we forgotten about the power of creative in retail media?

In the rush to capitalise on retail media, it seems like everyone is laser-focused on insights and data.

And while understanding the consumer journey and leveraging transactional data are undeniably crucial, there’s a question we need to ask: Are we losing sight of the actual thing the consumer will see…the ad creative?

Data can tell us who to target and when to engage, but it’s the creative that ultimately makes the connection. It’s the message, the visuals, and the storytelling that resonate with consumers, compelling them to take action. Without strong, engaging creative, all the insights in the world won’t move the needle.

As retail media networks expand, let’s not forget that the best data in the world is only as effective as the creative that brings it to life. We need to balance our obsession with data-driven targeting with a renewed focus on what makes ads truly impactful.

After all, at the end of the day, it’s the ad creative that leaves a lasting impression, not the algorithm behind it.

The pros and cons of consolidating data, bookings, measurement and reporting into one platform

Jordan Roberts

Senior Platforms Manager, GIG Retail

Scoping designing and implementing retail media platforms + training and ongoing support for our clients.

Jordan joined GIG in 2019, coming from previous roles in B2C digital marketing.

This is a subject we regularly discuss with clients, and ultimately the answer boils down to bespoke retailer requirements.

GIG’s Senior Platforms Manager, Jordan Roberts, outlines the key considerations to help guide your thinking.

A Retail Media Platform should consist of 5 key areas; Booking, Campaign Management, Billing, Measurement and Reporting, often each of these areas are managed by different platforms that serve that specific purpose. Before considering migrating those areas into one platform there are a few things that should be considered as, although it makes for a better user experience, it’s not always the best approach.

Pros:

1. Efficiency and Streamlined Operations: Consolidating all retail media activities into one platform can significantly enhance usability and operational efficiency. A single platform provides a centralised hub for booking, requirements gathering, measuring and reporting, reducing the complexity of managing multiple tools and systems. This streamlining can lead to faster decision-making processes and a reduction in administrative burdens.

2. Integrated Data and Insights: A single retail media platform means there will be one single version of the truth for data and all data can be reported on using one single platform as appose to needing to bring multiple data points/sources together.

3. Cost Savings: Using a single platform can reduce costs associated with licensing multiple tools and training staff to use various systems. The cost of development work would also be reduced if using a single platform as you wouldn’t need to develop multiple platforms to ensure they still speak to each other.

4. Consistency and Standardisation: Consolidating onto one platform can ensure consistency in data, measurement and reporting standards. This standardisation can eliminate discrepancies that arise from using different metrics and methodologies across various platforms. Consistent data can improve the accuracy of performance evaluations and strategic planning.

5. Simplified Vendor Management: Managing brands/advertisers across multiple platforms can be complex as each system could have inconsistent data, having one single version of the truth will lead to less data inaccuracies when billing.

Cons:

1. Lack of Flexibility: A single platform might not offer all the functions and features that the business requires, so the initial development work would be costly and time consuming especially if the platform doesn’t allow for individual account development

2. Risk of Platform Lock-In: Relying on a platform for all retail media activities can lead to platform lock-in, where the retailer becomes overly dependent on one provider, this can limit the retailer’s ability to switch platforms or adapt to new technologies and market trends without incurring significant costs and disruptions.

3. Scalability Issues: As a retailer grows and its needs become more complex, a single platform may struggle to scale effectively. Individual platforms often offer more advanced features and scalability options tailored to specific functions, whereas a consolidated platform may become a bottleneck for innovation and growth.

4. Potential for Higher Costs: While a single platform can reduce some costs, it may also lead to higher expenses if the platform charges premium prices for comprehensive services. If you require a high degree of complexity for one part of the platform and not the other, if the platform isn’t modular, you could be paying for under utilised features.

5. Innovation and Competitiveness: Area specific platforms such as Monday.com for workflow automation have a specific use case, meaning all their development goes into improving that one specific area, using a unified platform could mean that development/innovating is stunted due to the broad scope of the platform.

6. Evolving Retail Media Landscape: Retail media is in rapid growth and new formats are being released on a regular basis, which can prove to be challenging, as the way you sell website inventory is different to how you sell in store printed media – This can also be a ‘con’ for having a unified platform as some digital partners will have better inventory management systems that what can be custom-built in an integrated platform.

Conclusion

The decision to consolidate all retail media activities into one platform versus using the best platforms for specific needs involves weighing the benefits of efficiency, cost savings, and data integration against the risks of reduced flexibility, platform lock-in, and potential scalability issues. Retailers must carefully evaluate their unique needs, growth trajectories, and market conditions to determine the best approach for their retail media strategies.

At GIG Retail we have found that the specific needs and nuances of every retailer are different. What is good for retailer A may not serve the purpose of retailer B. Additionally, the growth roadmap differs between retailers and it is our job to foresee the ongoing needs of each retailer and future-proof their operating platforms, minimising long-term cost.

For these reasons we believe in finding the best solution for each element of a retailer’s operations. GIG Retail have extensive experience, past and present, working with multiple platform providers, and while the integration between platforms can present challenges, this is GIG’s challenge (not the retailer’s) – something we are adept at managing to achieve the optimal outcome and best long-term solution for retailers and brands.

Please contact us if you would like to discuss this in relation to your business.

John Lewis follows Waitrose with new retail media upgrade

GIG Retail Comment

John Lewis's new approach marks a significant advance for advertisers, enhancing their ability to measure media performance - a critical factor in driving brand investment. By providing access to customer shopping data and a supplier dashboard, they simplify targeted retail media purchasing, a step many retailers hesitate to take. This data is the key differentiator between traditional and retail media, enabling personalised shopping experiences and accurate ROI reporting through media attribution to sales. However, turning data into actionable insights is crucial for success. By integrating MyWaitrose and MyJohn Lewis loyalty programs, brands can better tailor their messaging, resulting in a more cohesive customer experience and improved campaign effectiveness.

31 July 2024

John Lewis has introduced a new retail media platform to help suppliers better connect with customers, launched in partnership with Epsilon. This aligns John Lewis with Waitrose, which implemented similar capabilities in November 2023.

The platform provides suppliers with a dashboard to access data on the performance of their advertising campaigns on the John Lewis website, including customer engagement metrics like click-through rates and sales performance.

This enhancement aims to offer more personalized advertising to customers based on their browsing and search history. It is part of John Lewis Partnership's broader effort to upgrade technology across its retail and supermarket brands to attract more shoppers.

Investments include AI and machine learning to improve store availability and service, website usability upgrades, and a unified loyalty program combining MyWaitrose and My John Lewis. The Epsilon partnership is expected to enhance customer experience by connecting shoppers with relevant brands and products at optimal times.

Jemma Haley, John Lewis' retail media business & proposition strategy lead, emphasized the goal of making it easier for customers to find brands and products that meet their needs through more targeted and relevant advertising. Epsilon European CEO Alban Villani highlighted the opportunity for brands to build long-term relationships with customers through this platform, enhancing both awareness and loyalty.

Full article available at Retail Gazette.

Deliveroo continues non-food play with a partnership with The Perfume Shop

25 July 2024

Deliveroo has partnered with The Perfume Shop to expand its non-food offerings, launching perfume deliveries from 21 stores in major UK cities like London, Manchester, and Glasgow within 25 minutes. This move is part of Deliveroo's "Deliveroo Shopping," which began in November and includes a wide range of retail products from electronics to toys.

The Perfume Shop partnership aligns with Deliveroo's strategy to offer diverse non-food items, enhancing the app's gifting functionality. The UK fragrance market is growing, with December 2023 sales exceeding £2bn, and Deliveroo has seen a 300% increase in in-app perfume searches.

Deliveroo's non-food expansion includes partnerships with Screwfix and Ann Summers. The app also collaborates with supermarkets and convenience stores to broaden its non-food inventory.

Eric French, COO at Deliveroo, highlighted the demand for gift deliveries, expressing excitement about the partnership's potential. The Perfume Shop's MD, Gill Smith, praised the collaboration for making fragrances more accessible and convenient for customers.

GIG Comment

This is a great story showing how retailers are using retail media to expand their offering into verticals outside of their core business. Partnerships such as this blend beautifully to provide customers with an enhanced experience, whilst feeding their need for convenience, while brands benefit by tapping into consumers in ‘buy-mode’ to convert browsing into purchases. As we approach the golden quarter and the usual uplift in gifting, expect to see this partnership flourish.

What are the characteristics of a successful retail media network and what are the key milestones for creating one?

Ultimately a successful RMN is one that drives huge incremental revenue & profit into the retailer by monetising ad spaces and customer data, while enhancing the customer experience and driving product sales. A winning RMN will integrate with the wider media ecosystem and broad marketing strategies to attract investment from a wide selection of brands.

1) Auditing your assets and opportunity for growth

The first step to launching an RMN is to understand the potential ad spaces that can be offered – across digital & physical assets, loyalty programmes and within customer data.

Then, are there areas for expansion such as new ad placements or conversion from cardboard to new digital assets? Are there any limits or restrictions on how much space can be dedicated to advertising? Is any mindset change required within the wider business before more space can be offered up to advertisers?

Are there any weaknesses within existing POS implementation processes – do any internal systems or networks need improving before any media bookings can be guaranteed?

Areas for potential partnership opportunities also need to be factored in, most often with technology partners to support advanced targeting and measurement capabilities.

2) Establishing your proposition – defining the target audience, shopper behaviours, and how these appeal to advertisers

As competition ramps up with more retailers offering up their ad spaces, audience relevance, size and understanding will be a key differentiator.

Key customer demographics need to be identified and reviewed against typical media buying audiences. A deep dive into customer behavioural data is required to bring the audience to life: Interests? Values? Purchase patterns? Basket size and frequency?

Typical customer journeys from awareness to purchase across online and instore need to be mapped out in order to identify key engagement points to influence the customer’s decisions. These touchpoints then need to be cross referenced against the media asset inventory to ensure ongoing investment is prioritised in these areas.

3) Understanding the existing market and how your product and selling proposition sits within it

Existing RMNs, especially those in the same category and of similar size, need to be identified and reviewed. Elements like the number of endemic brands, the size and value of the audience, the quality and quantity of available media assets as well as typical retailer business KPIs should be considered.

Its also vital to stay up to date with media industry trends and determine where there is un-met demand or room for innovation in the market to further inform the development roadmap.

The USPs need to be defined, what really sets the RMN apart from the others (audience value, superior data analytics, exclusive access to premium inventory, implementation excellence etc.).

Finally, a pricing model needs to be proposed that reflects a RMN’s market position, offering value to advertisers whilst maximising revenue & profit.

4) Planning your infrastructure and timeline for launch

4.a. Define the objectives within a business plan – set clear goals for revenue and profit.

4.b. Outline the strategic roadmap – have a clear timing plan for development milestones based on the budgets and the findings of the initial review.

4.c. Map out the end to end RMN operations – consider the processes, structures and systems required to deliver a great end to end experience for advertisers and guarantee compliance. Think about where marketing, ecommerce, instore retail and commercial teams need to work together and how they will interact.

4.d. Build the team – consider all the required capabilities at each stage of the roadmap and assemble the relevant cross functional team. What can be delivered in house via third parties, what training and development is required?

4.e. Develop the platform – choose the right technology stack for ad serving, targeting and reporting that can also integrate with existing systems; evaluate against the roadmap and budgets.

4.f. Create the inventory – define and package all the relevant media assets.

4.g. Create the rate cards – develop the competitive and flexible pricing structure for different ad formats and placements.

4.h. Market internally – ensure all the relevant teams are engaged and are working towards the same goals.

4.i. Test the operation – run pilot campaigns with select advertisers to test and refine the offering & processes and to produce case studies ahead of launch.

4.j. Go to market – promote the RMN to potential advertisers, have a clear marketing strategy that showcases the value proposition and success stories.

4.k. Ongoing optimisation – regularly review the strategic roadmap, considering any changes within the market and the RMN’s market position. Monitor BAU performance and gather feedback to make data driven, tactical adjustments.

4.l. Deliver the key milestones in the strategic roadmap – ensure there is capacity and capability to deliver the required strategic developments whilst maintaining a smooth, tactical operation.

The above represents a broad approach to building a RMN, but it’s important to remember that each retailer has specific needs and challenges. There isn’t a one-size fits all solution so it’s crucial to spend time understanding the retailer’s nuances before tailoring a bespoke solution and roadmap.

Erinne Boyes

Operations Director at GIG Retail

Erinne has been with GIG Retail since 2020 in which time she has managed media proposition, planning, sales and operational delivery for one of the UK’s largest retail media networks, as well as in an advisory role in the launch and growth of the Poundland Media Centre. Prior to joining GIG, Erinne spent 15 years working for global media agency networks in client service and media planning and buying, primarily focused on large retail clients.

GroupM and Tesco Media & Insight platform establish significant strategic media partnership

Tesco Media and Insight Platform, powered by dunnhumby, has announced a significant media partnership with GroupM, WPP’s media investment group, which will drive best-in-class delivery of data-led solutions, education, and innovation across all facets of retail media in the UK.

The deal represents the most significant single deal for Tesco Media and Insight Platform and is among the first of its kind focused specifically on the burgeoning retail media arena which covers on-site, off-site, and connected store offerings.

GIG Comment

This is an exciting but certainly not an unexpected development in the rapid evolution of retail media. Harnessing retailer’s first-party data will be a game changer for ATL media planning agencies and brands, and a lucrative new revenue stream for retailers. Inevitably it will lead to retail media inclusion as part of a full-funnel media solution, not just within the retailer’s media estate, but across all channels, as more brands demand added accountability from their marketing budgets.

It will also accelerate innovation in the retail space, as well as in technologies that enable hyper-real-time, personalised targeting. Thankfully, it should also help to accelerate a solution for the ongoing demand for standardisation, in media formats, measurement and reporting, that brands so desperately crave.

While GroupM’s partnership with Tesco will help to set a benchmark for the use of retailer data and subsequent media activations, the obvious next step in this evolution will be to expand the data-set across a retailer network to create a wealth of high quality audience segments across all verticals. Very exciting times ahead, but with many incarnations to come before the industry settle upon that elusive standardisation.

Mars Wrigley trials display unit made from cocoa beans

Mars Wrigley UK is testing a new display unit made from waste cocoa beans in Tesco stores. This material, dubbed ‘cocoa cardboard,’ combines waste cocoa bean shells with recycled paper as an eco-friendly alternative to corrugated cardboard.

Developed with sustainability consultancy Medoola and created by Kolorcraft, 75 pairs of these units were introduced in Tesco stores in Scotland on June 17, with 690 more pairs to be launched in England and Wales on July 3. These units, part of the Celebrations’ ‘Gift for teacher’ promotion, are said to perform as well as traditional materials.

Annelise Turner, Head of Digital Media at GIG says ‘This is such a great initiative from Mars Wrigley, showcasing their new cocoa bean waste shipper display units in Tesco. They cleverly combine sustainability with marketing, it’s a great step change for the instore retail media environment where printed POS is still highly prevalent. It’s a smart way to engage customers and promote eco-friendly values in the retail space. This move not only boosts their green credentials but also sets a solid example for other brands (and retailers) to follow, which I’m sure they will! Eco friendly marketing is exactly what the industry needs to move forward sustainably.’

To read the full article please visit The Grocer.

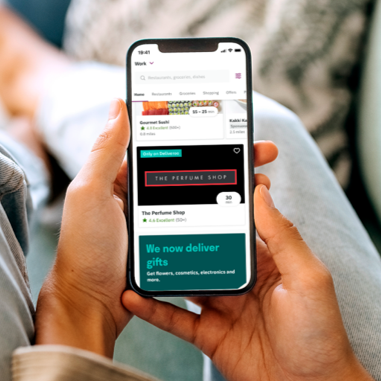

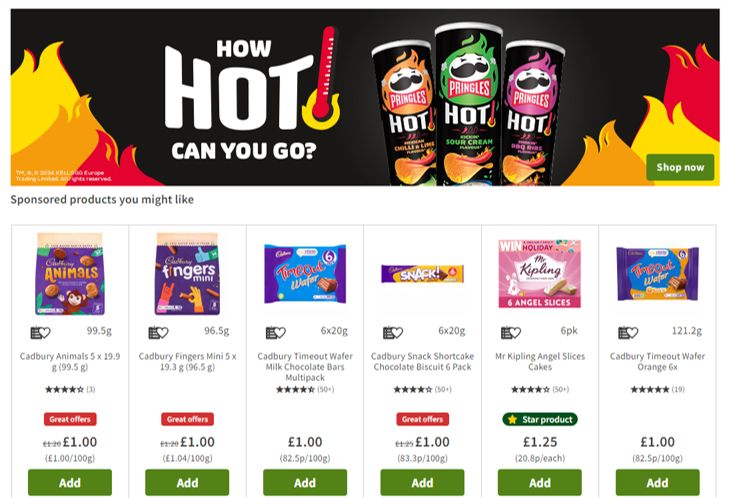

Retail Media: A rapidly growing advertising environment attracting huge brand investment.

Retail media has emerged as an important part of the media mix, growing rapidly over the last 10 years to become, some say, the third and biggest wave in advertising following search and social media. It has captivated brands with a unique blend of first-party data led targeting capability, and its ability to directly influence product sales, both in-store and online. It offers an unparalleled opportunity to connect with and influence shoppers at the crucial moment when purchase decisions are being made.

The importance of first-party data should not be under-estimated, particularly in the era of cookie deprecation. Retailers possess vast amounts of data about their customers' purchasing behaviour, preferences, and demographics, and by utilising this data, advertisers can precisely target their ads to specific audiences, increasing the likelihood of conversion. This level of precision targeting surpasses traditional advertising methods, where advertisers often rely on third-party data or broad demographic segments.

Additionally, retail media offers a seamless integration of advertising into the shopping experience. Unlike traditional interruptive ads, which can be seen as disruptive and intrusive, retail media placements feel native to the platform. Online, sponsored product listings or display ads appear alongside organic search results or product pages to become part of the browsing experience. In-store ad placements appear in close proximity to the featured product, alerting shoppers to value, range, quality or NPD messaging and driving standout within the category. This integration enhances ad relevance and increases engagement, as consumers are more likely to interact with ads that align with their current shopping intent.

Also attractive is the ability to measure and track campaign performance in real-time - metrics such as CTR, conversion rate and ROAS enable advertisers to optimise media performance and attribute specific media to their product sales - golden for any marketer. This accountability combined with the fact that retail media actually works in driving product sales, is the main reason for such rapid growth. In contrast, measuring the effectiveness of more traditional advertising channels can be challenging, particularly without that direct link between media and product sales.

In summary, retail media has emerged as a dynamic, rapidly evolving and rapidly growing advertising environment, fueled by its ability to leverage first-party data, integrate ads seamlessly into the shopping experience, and deliver measurable results. With brands increasingly seeking more effective ways to connect with consumers, retail media will inevitably play a greater role in the marketing mix, and it is no surprise that brands and advertising agencies are predicting huge investment growth in the years to come.

Monetising your retail estate creates a low cost, high margin driver of product sales.

45% - 90%

typical profit margins achieved through retail media

Monetising your retail estate is a strategic approach to maximising the revenue potential of your physical store locations and online platforms. By effectively leveraging your retail space, you transform it into a powerful driver of product sales, typically characterised by low operational costs and high profit margins.

While the setup of a retail media network (RMN) can be complex, most retailers start small and follow-up with a growth plan once they begin to realise the typically high profit margins associated with retail media. RMN growth does not necessarily mean high capital investment - there are OpEx opportunities that enable the implementation of up-front infrastructure, paid for through an agreed revenue share. Once the platforms are in place, the media execution is largely supplier-funded, with typical profit margins ranging from 45% - 90%.

The retail media portfolio options are almost endless, ranging from simple printed point-of-sale media, digital or interactive screens, experiential demonstration or sampling zones, right through to high-tech online targeting and rich media. Combined, the media portfolio creates multiple touchpoints to reflect the omnichannel nature of the shopper journey - guiding and inspiring the shopper to influence product choice and purchase, and ultimately enhancing the overall shopping experience and customer satisfaction.

In addition retailers can use their media portfolio to create supplier-funded co-branded sales opportunities through seasonal events of lifestyle moments. Working with a complimentary brand (or brands) to create new reasons for shoppers to visit is a powerful trade marketing tool that drives footfall, market share and incremental product sales.

It doesn’t stop there! Retailers have a key asset that is incredibly valuable to brands - their customers. Defined locations that attract a high concentration of people in a ‘buy’ mindset is every marketer’s dream. Even if the product or service is not sold by the retailer, brands will pay to access the right audience, particularly if they can benefit from the pinpoint targeting capability afforded by retailer’s first-party data. This means retailers can monetise carpark or foyer space by attracting non-endemic products and services or by hosting outdoor events, experiences or competitions that align with their customer’s lifestyle.

Ultimately, the key to successfully monetising your retail estate lies in creativity, flexibility, and a deep understanding of your audience. By continuously innovating and adapting to changing consumer preferences and market trends, retailers can attract audiences which in-turn unlocks media investment from brands. The margins achieved through retail media enable a sustainable competitive advantage that drives long-term profitability.

Attributing media investment to product sales makes retail media a must-have for brands.

The ability to attribute media investment directly to product sales marks a significant step-change for marketers, and something that makes retail media an important channel for brands seeking to maximise ROI and make data-led decisions that deliver tangible performance uplifts from their media investment.

One of the key advantages of retail media lies in its ability to leverage first-party data derived from consumer purchase behavior. By tapping into the wealth of transactional data available from retailers, brands gain unparalleled insights into consumer preferences, shopping habits, and purchase intent. This granular understanding enables them to target advertising with precision, delivering personalised messages to the right audience at the right moment in their purchasing journey. As a result, brands can drive higher conversion rates and maximise the impact of their advertising spend.

The link between retail media and product sales creates a closed-loop for marketers who attribute their advertising efforts directly to revenue generation. Through advanced attribution models and analytics tools, brands can track the entire customer journey from ad exposure to purchase completion, attributing sales back to specific media touchpoints. This robust attribution capability not only provides clarity on the effectiveness of marketing campaigns but also enables optimisation in real time, allowing brands to allocate budget towards the most impactful channels and tactics.

The rise of e-commerce and omnichannel retailing has amplified the importance of retail media as a strategic marketing channel. With online shopping becoming increasingly popular, brands have access to a vast digital marketplace where they can engage with consumers across multiple touchpoints. Retailers with robust e-commerce platforms offer advertisers opportunities to reach shoppers at various stages of the purchase funnel, from initial product discovery to post-purchase incentives to return. By investing in retail media, brands can establish a strong presence within digital environments and capitalise on the growing trend of online shopping.

As retail media begins to harness emerging technologies such as machine learning and artificial intelligence (AI), brands are now able to enhance their targeting and personalisation capabilities. Predictive analytics and algorithmic optimisation enables hyper-relevant content and tailored experiences which drives engagement, sales and loyalty.

To summarise, the ability to attribute media investment to product sales highlights the importance of retail media for brands striving for measurable results and a clear view of the positive impact on their business. As the marketing landscape continues to evolve, brands that embrace retail media as a cornerstone of their advertising strategy will gain a competitive edge in driving revenue and building lasting customer relationships.

Retailer’s first-party data is golden to brands who wish to target shoppers.

Retailers collect an enormous amount of customer data, whether that’s transaction history, browsing patterns, product preferences, demographics or contextual data such as time and location. This rich data-set is incredibly valuable to marketers because it can be used to reach consumers with tailored messaging at precisely the right moment in the customer journey, increasing the likelihood of engagement and conversion. In contrast, third-party data used by most other advertising channels can be limited in granularity and accuracy leading to wastage in mis-targeted advertising.

The benefits of first-party data are clear but there is more. By its very nature, retail media can accurately connect with consumers in buy-mode - when they are more receptive to inspiration or suggestion, and actively looking to make a purchase. By analysing past purchase behaviour and identifying signals of intent such as recently viewed items or abandoned baskets, brands can actively target consumers to capitalise on moments of high purchase intent.

By building out granular customer segments, retailers can make it easy for brands to reach their desired audience as well as inform the messaging that is most likely to drive conversion. By recognising the shopper’s preferences and needs, the customer experience improves, increasing the likelihood of conversion and return visits.

Finally, the ability to measure performance in real-time means brands can optimise their media and messaging to maximise ROI and to inform future media planning.

In summary, first-party data combined with the ability to reach consumers in buy-mode is the key differentiator between retail media and more traditional advertising channels. This doesn’t mean that other media channels should be ignored - far from it - but when marketing investment needs to demonstrate accountability there is no better channel than retail media.

Full-funnel retail media solutions enable brands to deliver the right message at the right time - increasing relevancy.

Retail media has been historically viewed as a lower-funnel media channel used to drive purchase. But, with the scale of audience and the ever-increasing media options within its portfolio, retail media is expanding up the funnel - with some able to achieve the reach associated with traditional broadcast channels. The obvious benefit for retailers is that they are able to drive huge audiences of consumers directly to their stores and websites.

The full-funnel retail media approach means that brands can deliver targeted messages through every stage of the customer journey with the added benefit of using their first-party data for enhanced targeting, resulting in increased relevancy to their customers. This means that brands can effectively guide consumers through the decision-making process and maximise the impact of their marketing campaigns.

At the top of the funnel, where consumers are in the awareness stage, brands leverage retail media solutions to build brand visibility and capture the attention of potential customers. Through strategic placement of display ads, sponsored content, and native advertising across relevant digital platforms and physical store environments, brands can introduce themselves to a broad audience and create initial brand awareness, laying the foundation for future engagement.

As consumers progress down the funnel and enter the consideration stage, where they actively evaluate different products and brands, full-funnel retail media solutions enable brands to deliver more targeted and personalised messaging. Through tactics such as product recommendations, customer reviews, and cross-category inspiration, brands can provide valuable information and guidance to help consumers make informed purchase decisions. By tailoring content based on user preferences, past interactions, and browsing behaviour, brands can increase relevancy and drive deeper engagement with their target audience.

Finally, at the bottom of the funnel, where consumers are in the conversion stage and ready to make a purchase, full-funnel retail media solutions empower brands to deliver compelling calls-to-action and incentives to drive immediate action. Whether that’s through promotional offers, limited-time discounts, or personalised retargeting campaigns, brands can create a sense of urgency and encourage consumers to complete their purchase. By leveraging data-driven targeting and dynamic ad creatives, brands can deliver the right message to the right audience at the right time, maximizing conversion rates and driving incremental sales.

One of the key advantages of full-funnel retail media solutions is their ability to seamlessly integrate across digital and physical retail channels, creating a cohesive and omnichannel shopping experience for consumers. By leveraging omnichannel marketing strategies, brands can ensure consistent messaging and branding across all touchpoints, regardless of whether consumers are browsing online or in-store. This integrated approach not only increases brand visibility and recognition but also enhances the overall customer experience.

High margin, net new revenue funds trade marketing and an improved shopper experience.

Aside from the obvious benefits to brands, retail media can create a significant new revenue stream for retailers because it monetises their prime locations and their incredibly valuable audience of shoppers. Because the retail media network is owned by the retailer and funded by supplier/brand investment, profit margins are typically high, particularly in digital media where there are minimal implementation costs and high implementation compliance.

Retail media is also net-new revenue to retailers. It does not erode or cannibalise existing product sales revenue or trade margins and it has a minimal impact on operational costs. For established retail media networks, retail media is often their most profitable revenue stream (as a percentage), and for new RMNs it introduces a significant upside to the P&L.

High margins from retail media gives retailers the financial flexibility to invest in improvements to their estate, product development, external trade marketing that motivates new customers and drives increased footfall, and it gives them a competitive advantage both in share of market and share of supplier investment. Perhaps most importantly, it improves the shopper’s experience by creating memorable moments that resonate with shoppers and drive brand affinity, leading to increased visit frequency and incremental product sales.

Many retailers are only scratching the surface on their retail media potential.

Retail media offers a wealth of opportunity for retailers, but in GIG’s experience, many have not committed to maximising the full potential. This may be due to the initial setup cost, lack of a robust implementation and growth strategy, the complexity, or simply fear of the unknown.

Some retailers flirt with co-branded window posters or some printed POS media, while others go as far as appointing a digital media partner to enable sponsored products on their website. While these are all strides in the right direction, only when a retailer’s media portfolio expands to mirror the omnichannel way in which people shop, will it truly begin to make lasting returns.

The key is to deliver a full-funnel media experience that grabs initial attention, then guides the shopper through every step in their path to purchase, providing relevant messaging that influences their choices along the way. This isn’t about bombarding shoppers with repetitive ads, rather informing them of product location, quality, provenance, NPD or value, so they are equipped to make informed decisions.

For further brand immersion, experiential activations in-store, competitions, gamification or rich media can be used to engage shoppers, facilitate sampling and build brand affinity.

Layered on top of this is the data and technology that enables audience segmentation, targeting and measurement, and the resulting analytics that inform future strategy and media planning. Combined, this provides retailers and their suppliers with the tools required to effectively activate media and generate returns that justify their investment.

By embracing the full potential of retail media, retailers can not only drive additional revenue streams but also strengthen customer relationships, enhance brand loyalty, and ultimately improve the overall shopping experience. As the retail landscape continues to evolve, those who effectively harness the power of retail media will undoubtedly gain a competitive edge in the market.